All Categories

Featured

Table of Contents

Keeping your designations up to date can ensure that your annuity will be handled according to your desires ought to you pass away suddenly. An annual review, major life events can trigger annuity proprietors to take an additional look at their recipient selections.

As with any kind of financial product, seeking the aid of a monetary advisor can be useful. An economic organizer can assist you through annuity administration processes, consisting of the approaches for upgrading your contract's recipient. If no recipient is named, the payment of an annuity's survivor benefit goes to the estate of the annuity holder.

Acquiring an annuity can be an excellent windfall, however can also elevate unexpected tax obligation responsibilities and administrative problems to manage. In this post we cover a couple of essentials to be aware of when you acquire an annuity. First, know that there are 2 types on annuities from a tax viewpoint: Certified, or non-qualified.

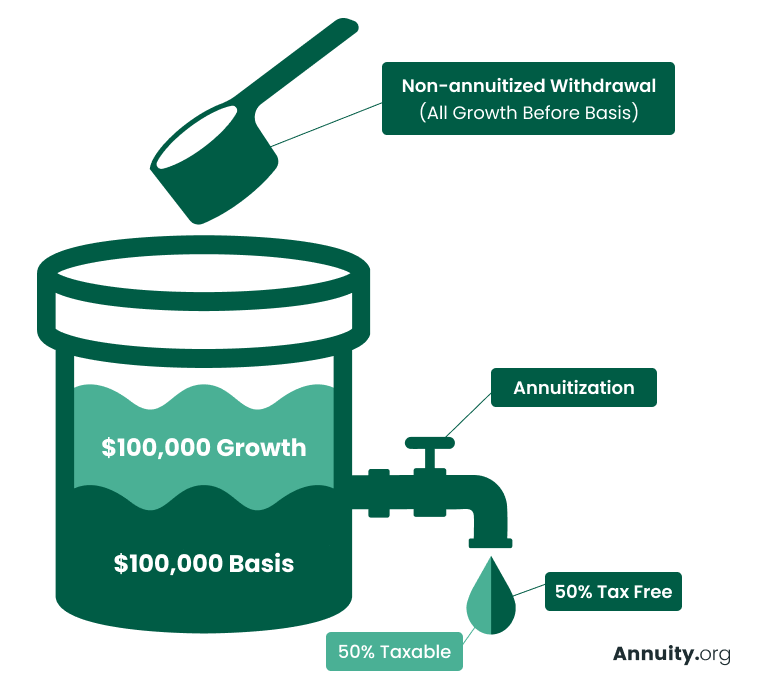

When you take cash out of an inherited qualified annuity, the total withdrawn will certainly be counted as taxable earnings and strained at your regular earnings tax price, which can be fairly high relying on your financial circumstance. Non-qualified annuities were moneyed with financial savings that already had actually tax obligations paid. You will not owe tax obligations on the initial price basis (the overall payments made at first right into the annuity), however you will certainly still owe tax obligations on the growth of the investments nonetheless which will still be tired as earnings to you.

Specifically if the initial annuity proprietor had been receiving repayments from the insurance coverage firm. Annuities are usually made to provide income for the original annuity owner, and afterwards cease settlements when the initial owner, and possibly their partner, have passed. There are a few situations where an annuity might leave an advantage for the beneficiary acquiring the annuity: This implies that the preliminary owner of the annuity was not getting normal settlements from the annuity.

The beneficiaries will have several options for exactly how to receive their payment: They might keep the money in the annuity, and have the properties relocated to an acquired annuity account (Annuity rates). In this instance the assets may still continue to be spent and proceed to grow, nonetheless there will certainly be needed withdrawal rules to be familiar with

Taxes on Annuity Withdrawal Options inheritance

You may also have the ability to pay out and obtain a swelling sum settlement from the inherited annuity. Be sure you understand the tax influences of this decision, or talk with an economic expert, since you might be subject to substantial revenue tax liability by making this political election. If you choose a lump-sum payment option on a certified annuity, you will based on income taxes on the entire worth of the annuity.

An additional feature that might exist for annuities is an ensured survivor benefit (Structured annuities). If the initial proprietor of the annuity elected this function, the recipient will be eligible for an once swelling sum advantage. Exactly how this is exhausted will certainly rely on the sort of annuity and the worth of the survivor benefit

The details regulations you must adhere to depend upon your connection to the individual that died, the sort of annuity, and the wording in the annuity agreement at time of purchase. You will have a collection time frame that you have to withdrawal the properties from the annuity after the initial proprietors fatality.

As a result of the tax consequences of withdrawals from annuities, this means you require to very carefully plan on the ideal means to withdraw from the account with the most affordable quantity in taxes paid. Taking a big swelling sum might push you right into very high tax braces and cause a larger part of your inheritance mosting likely to pay the tax obligation bill.

It is additionally important to recognize that annuities can be traded. This is recognized as a 1035 exchange and permits you to move the cash from a certified or non-qualified annuity right into a different annuity with an additional insurance company. Arnold and Mote Wide Range Management is a fiduciary, fee-only economic planner.

Do beneficiaries pay taxes on inherited Guaranteed Annuities

Annuities are among the several devices financiers have for building wealth and safeguarding their financial health. An inherited annuity can do the same for you as a beneficiary. are agreements in between the insurance provider that provide them and individuals who acquire them. Although there are various sorts of annuities, each with its very own benefits and features, the key element of an annuity is that it pays either a series of payments or a swelling sum according to the agreement terms.

If you recently acquired an annuity, you might not know where to begin. That's entirely understandablehere's what you ought to recognize. In enhancement to the insurance provider, several celebrations are associated with an annuity contract. Annuity owner: The individual who gets in right into and pays for the annuity agreement is the owner.

An annuity may have co-owners, which is commonly the situation with partners. The owner and annuitant may be the very same individual, such as when somebody purchases an annuity (as the proprietor) to provide them with a repayment stream for their (the annuitant's) life.

Annuities with numerous annuitants are called joint-life annuities. Just like several owners, joint-life annuities are an usual framework with couples due to the fact that the annuity proceeds to pay the surviving spouse after the first partner passes. This can supply income protection in retirement. Beneficiaries: Annuity beneficiaries are the events to receive any kind of suitable survivor benefit.

When a fatality benefit is set off, payments may depend in component on whether the proprietor had actually already started to obtain annuity settlements. An inherited annuity fatality benefit functions in different ways if the annuitant had not been already getting annuity repayments at the time of their passing away.

When the advantage is paid to you as a round figure, you obtain the entire amount in a solitary payment. If you choose to receive a settlement stream, you will have a number of options offered, depending upon the contract. If the proprietor was already getting annuity settlements at the time of death, then the annuity agreement may just terminate.

Table of Contents

Latest Posts

Understanding Financial Strategies Key Insights on Retirement Income Fixed Vs Variable Annuity Breaking Down the Basics of Fixed Income Annuity Vs Variable Annuity Pros and Cons of Various Financial O

Decoding How Investment Plans Work Key Insights on Variable Vs Fixed Annuity Breaking Down the Basics of Investment Plans Features of Fixed Interest Annuity Vs Variable Investment Annuity Why Fixed In

Understanding Fixed Vs Variable Annuity Pros Cons A Closer Look at How Retirement Planning Works What Is Variable Annuity Vs Fixed Annuity? Pros and Cons of Various Financial Options Why Choosing the

More

Latest Posts